Frequently Asked Questions

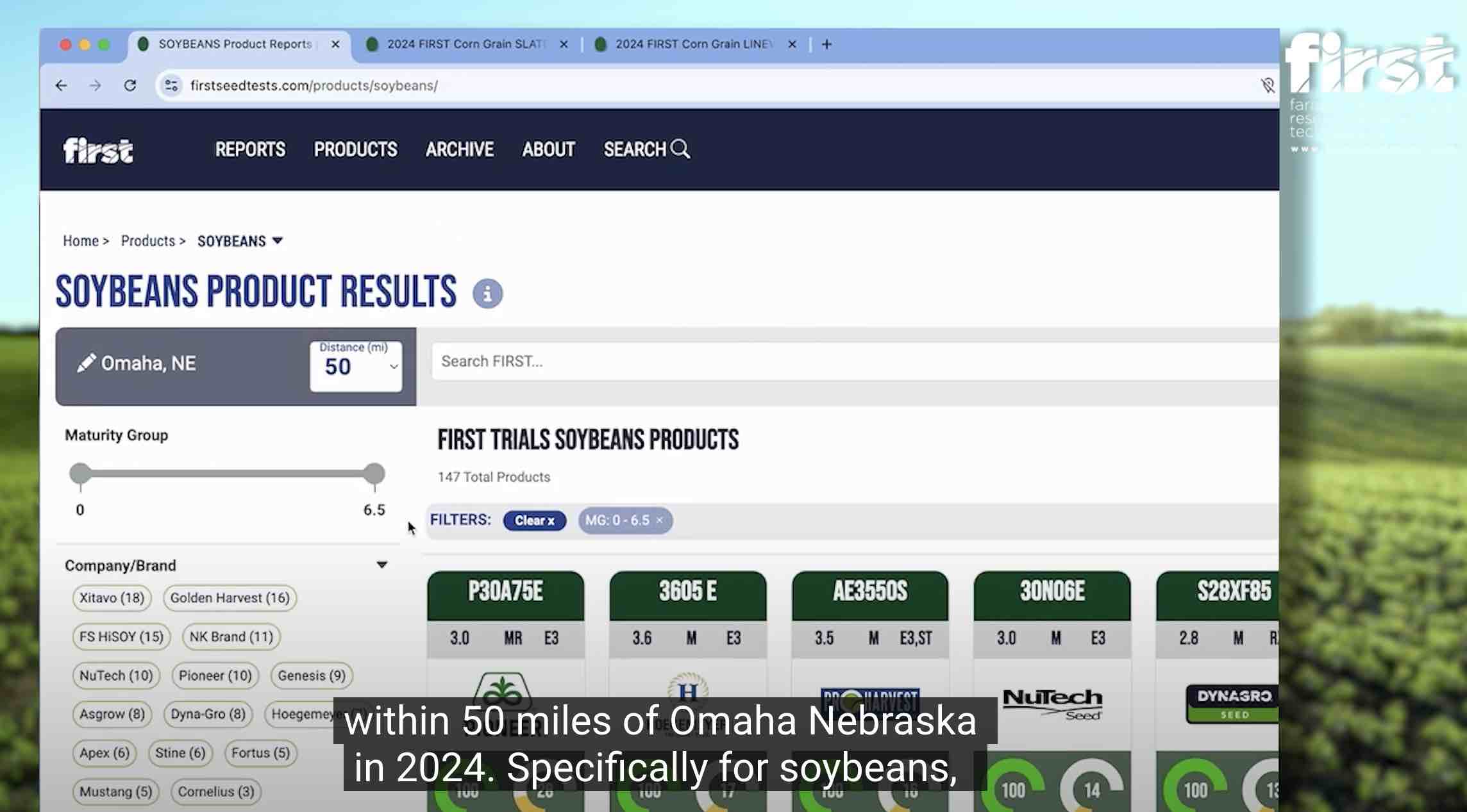

My favorite seed company's products are not included in your tests. Why is that?With the exception of check products, neither FIRST managers nor host farmers choose the products entered in our tests. Seed companies do. Corporate culture or perceived value of FIRST results weigh heavily in the business decision whether or not to participate in FIRST trials. If you value FIRST results and key companies are not participating, express your concerns to the seed company. Are different products tested at each site in a region?No. Within a region, all locations include the exact same seed products. This approach provides valid apples to apples comparisons in our Region Summary reports. How many replications are at each site, and across a region? Why is this important?For all corn and soybean tests, each product is replicated (reps) 3 times per location. The exact same corn seed products are replicated 18 times within a region (6 locations x 3 reps/location) or 20 times (5 locations x 4 reps/location) and soybean products are replicated 12 times within a region (4 locations x 3 reps/location). Replications are important to get a true picture of the yield potential for a product. The more replications we test, the better our chance of determining the true yield potential of a product. I'm interested in yields of test plots that are close to me. Why should I look at performance across multiple sites (Region Summaries or Product Reports)?Yield results from local plots demonstrate product performance for the growing conditions within that area. However, it is unlikely you will have the same growing conditions next year, likely impacting product performance. Yield results from multiple locations across a wide geography demonstrate product performance under a diverse range of growing conditions. Choosing a product that consistently delivers above average performance across a wide geography will improve your odds of obtaining excellent yields when growing conditions vary from year to year. How can I find the products results for the brands and traits I'm interested in?The Product Reports page has filters and search capability to narrow down results to products of interest. Check out this video tutorial on how to use FIRST's website to drill down to the information you need. Does FIRST use small plots?We use small plot research techniques. All FIRST test plots are approximately 10 ft wide and 40 ft long. For more details, see FIRST Methodology and Procedures. I have been told small plots do not provide true yield results. Why does FIRST use small plot research?Every issue has trade offs and this is no different. Every commercial seed product was developed using small plot results. Since corn and soybean yields continue to improve, small plot results must work. FIRST seed testing tries to show the relative yield difference across a large number of products. For this approach, small plot research works well. Our field managers utilize techniques to minimize factors that limit yield potential associated with small plots. Larger strip plots can deliver a better indication of maximum yield potential. However, this approach can only compare a small number of products uniformly, especially in areas with variable soil types. Since producers like the fact that our tests compare many products, we feel small plot testing provides the best solution for yield trials. What is Gross Income, and how should I use this information?Gross Income is the dollar value of the grain less drying costs to reach 15% grain moisture. If you desire high moisture corn grain for feed, Gross Income is irrelevant to you. However, if you are selling or storing low moisture corn, you should select products with the highest gross income to maximize profit potential. For example, hybrid A yields 200 bu/acre at 25% moisture and $550/acre gross income; hybrid B yields 185 bu/acre at 15% moisture and $555/acre gross income. Despite having lower yield, hybrid B is a more profitable choice due to having drier grain than hybrid A. How does FIRST determine the Top 30 reported products?All product results are first sorted from high to low based on Gross Income. Products are assigned a rank (1 = highest) for Gross Income. All information for the Top 30 Gross Income products are then sorted by Grain Yield from high to low and presented in tabular form. Why are only the Top 30 products shown in your data tables?All growers strive to produce above average crop yields by selecting the top producing products for their geography. By presenting only the Top 30 performers, we help narrow the focus to only the best products in that test. Growers need to select products that consistently deliver above average performance across a broad variety of conditions. The Top 30 products in our Region Summaries provide the greatest potential to deliver consistent above average performance and maximum gross income. What parameters are considered in FIRST grain yield calculations?Corn grain bushel/acre calculations adjust to 15% moisture and 56 lb corn/bushel, typical commercial standards. In addition, corn is adjusted for shrinkage due to moisture and invisible loss. Soybean grain yield is adjusted to 13% moisture and 60 lb soybean/bushel. Grain shrinkage is not factored into our soybean yield calculations since they are below 13% moisture at harvest. Your grain shrinkage factor is much higher than what my grain elevator uses. How is your factor derived?There are 2 shrink factors that grain merchants may consider when buying grain, moisture shrink and invisible (handling) shrink. Many grain merchant only deduct for moisture shrink to account for water weight lost from drying. Other merchants additionally consider invisible shrink, losses for broken kernels, foreign matter, volatile compounds or oils lost in the drying process. FIRST has chosen to use a Constant Shrink Factor (aka pencil shrink) which pools both moisture and invisible shrink into one factor (1.3 to 1.4 typically) for our calculations. Commercially, it is not unusual for the Constant Shrink Factor to range from 1.2 to 1.5% per point. What is the LSD (0.10) value in your tables?Least Significant Difference (LSD) is a statistically derived value that is used to show that 2 products are truly different based on yield. If the yield difference between 2 products is greater than or equal to the LSD value, a person can claim one product is statistically different than the other. For example, Hybrid A and Hybrid B yield 200 and 190 bu/A, respectively, and the test LSD is 5 bu/A. Hybrid A is statistically different than Hybrid B because their yield difference of 10 bu (200-190) is greater than or equal to the LSD value 5 bu/A. In your corn data tables, why are the results occasionally italicized?It is well documented that later maturing corn products typically have greater yield potential than early season products. FIRST insists that all products in a test fall within a defined maturity range for valid comparisons. Using statistical analysis of grain moisture, we can identify products that lie outside of the defined maturity range for the trial. Those outlier product results are italicized so readers realize this product may have an unfair yield advantage by exceeding the maturity limit. Why can I find products in the Region Summary with yields listed greater than those in the Top 30 Harvest Report for a location?Harvest Report data tables include only the Top 30 Gross Income products. Frequently there are higher yielding products with higher grain moisture and lower Gross Income that fall just outside of the Top 30. Products that miss the Top 30 at that location may reappear in the Region Summary Top 30, which are selected in the same way: top 30 products by gross income across all observations in the region. What things can I learn by comparing the check hybrids between early and full season tests at each site and across the region?At FIRST test locations with multiple tests, the early and full season tests are positioned adjacent to each other. Despite the proximity, variations in soil, fertility, and moisture will create yield differences between tests. To measure this difference, an identical "Check" hybrid is included in both tests. This yield difference is useful for comparing products across the Early and Full Season tests. For example, if the Full Season check has a 3 bu/acre advantage over the Early Season check, add 3 bu/acre to an Early Season test product yield when comparing to Full Season test product. PLEASE NOTE - This practice is not statistically valid and should only be used as a performance indicator. |